Living as a military family comes with unique challenges and rewards, especially when it comes to managing finances. I know firsthand how tough it can be to balance family life, career, and personal finances while constantly moving. One of the best ways we’ve managed our finances as a military family is by taking advantage of credit cards that waive annual fees and offer valuable rewards. These cards not only provide financial relief but also make travel and everyday life a lot easier and more enjoyable.

In this post, I’ll share four credit cards—the American Express Platinum Card, Chase Sapphire Reserve, Korean Air Skypass Visa Infinite Card, and United Club Infinite Card—that offer fantastic benefits to military families. I’ll walk you through their features and help you understand which card might be the best fit for your lifestyle.

Before we begin…

Do military get credit card fees waived?

Yes, military members can receive the benefit of waived annual fees on certain credit cards. Specifically, under the Military Lending Act (MLA) or the Servicemembers Civil Relief Act (SCRA), active-duty military members and their families can have annual fees waived on many credit cards.

Is Amex free for the military?

Yes, the American Express (Amex) Platinum Card is free for military families. This benefit is provided under the Military Lending Act (MLA), which waives the annual fee for active-duty military members and their spouses.

1. American Express Platinum Card

- Annual Fee: $695 (waived for military families under the Military Lending Act)

- Key Benefits:

- Access to over 1,400 airport lounges worldwide, including Centurion Lounges

- Up to $200 in airline fee credits annually

- $200 hotel credit for Fine Hotels & Resorts or The Hotel Collection bookings

- $240 digital entertainment credit for select subscriptions

- Comprehensive travel insurance, including trip cancellation and baggage coverage

- Best For : Frequent travelers looking to maximize lounge access and enjoy luxury travel experiences. For us, this card has been invaluable during our frequent moves and travel, providing us with access to lounges and travel credits that make family trips a breeze.

2. Chase Sapphire Reserve

- Annual Fee: $550 (waived for military families under the Servicemembers Civil Relief Act)

- Key Benefits:

- 3x points on dining and travel

- $300 annual travel credit

- Priority Pass membership for lounge access

- Comprehensive travel insurance, including trip interruption and emergency evacuation

- Redeem points for 50% more value through Chase Ultimate Rewards

- Best For: Families who prioritize dining and earning flexible travel rewards. We’ve been able to maximize this card’s benefits by using the points for family vacations

3. Korean Air Skypass Visa Infinite Card

- Annual Fee: $450 (waived for military families)

- Key Benefits:

- Earn 2 miles per dollar spent on Korean Air ticket purchases

- Complimentary access to Korean Air lounges

- Exclusive discounts on Korean Air flights

- Special insurance for travel accidents and delays

- Best For: Frequent travelers to or through South Korea who value Korean Air’s premium services. If you’re traveling back to Korea or taking trips through Korean Air, this card is definitely worth considering.

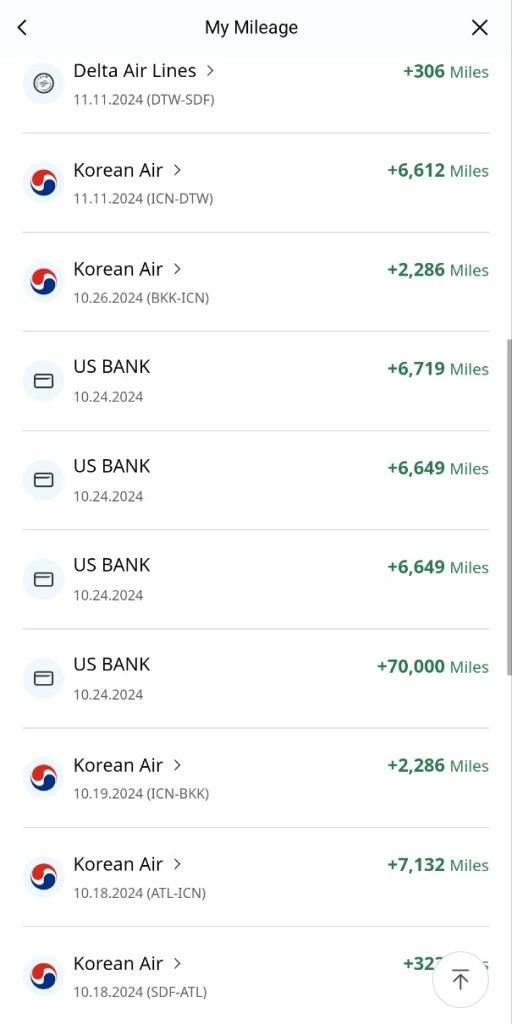

- I recently opened a Korean Air Skypass Card and earned over 100,000 points. When combined with the 30,000 points I already had, I now have enough for two business class tickets! I’m excited to use them for my upcoming trip to Korea later this year. It’s a fantastic way to make travel more comfortable and rewarding.

4. United Club Infinite Card

- Annual Fee: $525 (waived for military families)

- Key Benefits:

- Unlimited access to United Club lounges

- 4x miles on United ticket purchases

- Complimentary Premier Access for expedited check-in and boarding

- Free first and second checked bags for United flights

- Travel and purchase protection benefits

- Best For: Loyal United Airlines customers looking for premium travel perks.

Tips for Maximizing Benefits

- Understand the Annual Fee Waiver Benefits: As a military spouse, I know how expensive credit card fees can be, especially when you have other priorities like moving, family care, or education. Thanks to the MLA and SCRA, we can get these high fees waived, which is a huge relief. Be sure to apply for the waiver to save money and take full advantage of the card’s rewards and perks.

- Combine Credits and Benefits Strategically: After years of managing family travel, I’ve learned how to strategically combine travel credits, lounge access, and reward points to maximize savings. For instance, using travel credits to offset airfare costs while simultaneously using lounge access to make airport waits more comfortable has made our family trips much smoother. And don’t forget to accumulate points to redeem for future hotel stays or flights.

- Stay Organized to Avoid Missing Rewards: I’ve often found myself scrambling to remember which benefits I need to use and when. To avoid missing out on rewards or credits, I’ve started using a simple spreadsheet to track all the key dates and benefits for each card. Setting reminders on my phone helps too, ensuring I don’t miss out on valuable perks. Trust me, staying organized can save you time and money in the long run.

Recently, we had the opportunity to use our credit card points for an unforgettable experience. We flew business class on Hawaiian Airlines from Hawaii to Korea, all thanks to the points we’ve accumulated. Additionally, we were able to redeem our travel credits—$300 in total—covering our rides with Uber and Lyft. Every trip was made even more enjoyable with access to premium lounges, including Centurion Lounge, Delta Sky Club, and United Club. These are just a few of the countless benefits available to military families, and I truly hope you’ll make the most of them. By being strategic and mindful of these perks, you can significantly enhance your travel experiences while saving money. There are so many rewards to discover—take full advantage of them to make your journeys as smooth and enjoyable as possible.

During my recent trip to Nashville, I was able to fully utilize the benefits of my American Express Platinum Card. From enjoying access to airport lounges to using travel credits, it made the experience much more comfortable and cost-effective. If you want to read more about how I maximized my card benefits on this trip, you can check out my detailed travel experience :